July shipments increased 134 % to 45.9 million pounds, setting a monthly record and the second highest delivery month of the year. Exports for the crop year now total 423.1 million pounds, up 5.7 % from a year ago and a new record for annual supply. India led global demand, with importers bringing forward their volumes ahead of the early Diwali festival.

The market is shifting from pricing to execution, with timing of arrival, kernel size and quality driving short-term buying decisions. While some Diwali demand is still open, strong inflows in July suggest that additional demand is likely to be met locally. The general sentiment remains cautious, with forward hedging closely linked to crop yield and early quality assessments.

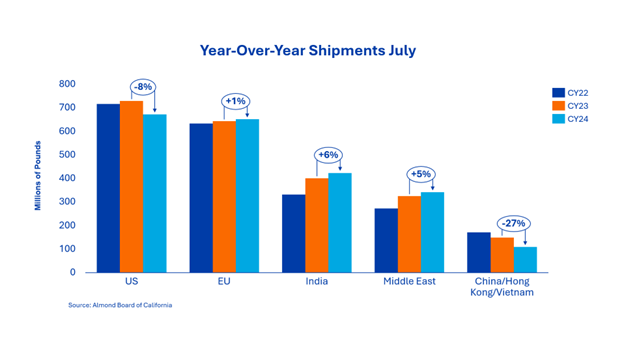

Combined shipments to the region totaled just over 3 million pounds in July, down 27 % since the start of the year. This weakness was largely expected and reflects the continued impact of tariffs restricting direct trade with China. Vietnam, on the other hand, recorded a year-on-year increase of 36 %, cementing its role as a high value-added processing and transshipment hub for Californian almonds.

After a slow start to the 2024 crop year, Europe closed the season with a year-on-year increase of 1.3 %. July shipments reached 55.5 million pounds, an increase of 15 % compared to the previous year. Now that there is clarity on tariffs, advance procurement is expected to take a more deliberate, phased approach as buyers adjust their coverage to fourth quarter consumption trends.

The region ended the season up 5 % at 340.7 million pounds, led by Saudi Arabia, Turkey and Jordan as primary growth markets. July shipments were down 21 % year-on-year due to increased stocks at destination and continued price differentials between origin and destination. Spot market activity remained subdued due to seasonal weakness in consumption and continued political instability. Interest in futures contracts for the 2025 harvest is starting to increase as buyers position themselves early ahead of Ramadan 2026 to secure supplies in time for the peak demand during the holidays.

Deliveries in July totaled 50.15 million pounds, a decrease of 5.6 % compared to the same period last year. This brings year-to-date shipments to 671 million pounds, a decrease of 7.8 % from the previous year. Last year was a challenging year for domestic demand, primarily due to ongoing economic headwinds. This, combined with the fact that the U.S. Department of Agriculture (USDA) did not repeat its previous year's purchase of 20 million pounds, resulted in final shipments reaching their lowest level since the 2015/16 crop year. Following the June objective estimate and position report, market activity picked up as buyers gained confidence in meeting first quarter demand. Despite this upturn, significant demand remains to be met for the remainder of the 2025 calendar year.

The new sales figures for this month showed strong momentum, with commitments for the 2024 harvest totaling 100.3 million pounds, an increase of 43.4 % year-on-year.

Sales of the new crop also increased, reaching 173.4 million pounds, an increase of 60.9 % over the previous year. Despite this remarkable growth, total commitments for the 2025 harvest remain below the previous year's level.

The harvest has just begun and it is still too early to make any predictions about production volume or quality.

As the season progresses, the industry will continue to focus on yields and actual yields to determine whether actual production matches or deviates from the objective estimate.

The industry closes the 2024 harvest year with a positive balance, with total deliveries only falling by -1.7 %. Inventory levels remain largely unchanged from the previous year, indicating a balanced relationship between supply and demand. Market activity increased as prices initially fell sharply after the objective estimate, but then stabilized and recovered as buyers took advantage of lower prices and limited availability. Prices are expected to remain strong as buying continues in the coming weeks.

The harvest is underway and clarity on the 2025 harvest will emerge once the quality, size and overall supply potential of the crop has been assessed.

Senior Sales Director Nut Ingredients