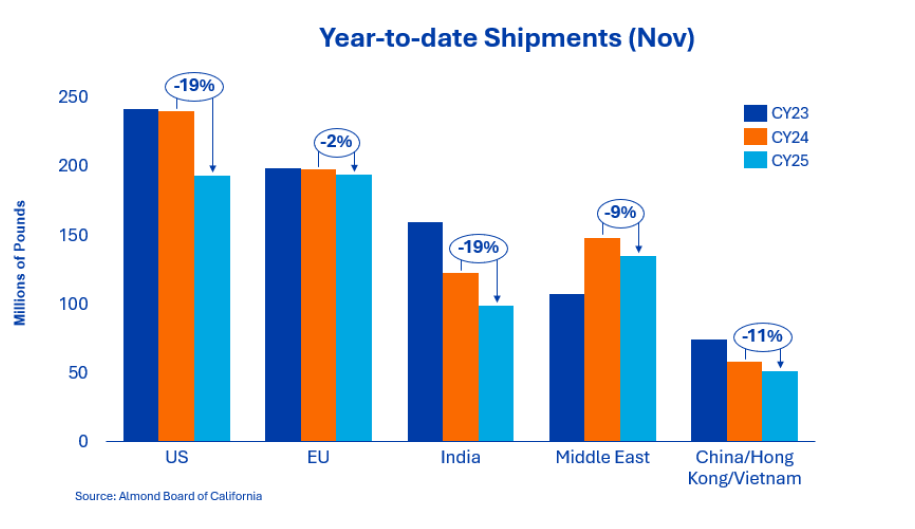

Deliveries to India since the beginning of the year have totaled just over 99 million pounds, representing a decline of approximately 19% compared to the previous year. The slower pace reflects more deliberate purchasing patterns and the timing of forward hedging rather than a structural decline in underlying demand. India remains undersupplied into early 2026, and the market's forward demand continues to support a constructive, stable demand outlook.

Market activities in the region continue to develop differently. Shipments from China/Hong Kong have declined by 75 % since the beginning of the year, in line with ongoing macroeconomic and trade-related constraints. Vietnam is a clear outperformer with an increase of 82 % since the beginning of the year, driven by strong demand for ingredients and opportunistic purchases ahead of the Lunar New Year. Overall, the region is down 13 % for November and 11 % since the beginning of the year. Southeast Asia's strength continues to offset weakness in Greater China and remains one of the most dynamic centers of demand for the industry this season.

Deliveries within Europe remain largely unchanged year-on-year, declining by only 2% this season. Buyers continue to be selective, meeting their needs locally as required. Countries with particularly good results include Spain and Italy, which have seen an increase in activity compared to last year. Core markets such as Germany and the UK remain stable, reflecting general macroeconomic caution but also stable almond consumption.

The Middle East remains a reliable region with high demand. Total deliveries are 9% below last year's level. Major importers such as the United Arab Emirates, Turkey, and Saudi Arabia are only marginally covered and are focusing on premium specifications and larger sizes, which is strengthening the stable price structures in these segments. While volumes have declined slightly year-on-year, demand for quality and consistency remains high.

Deliveries in November reached 47.3 million pounds, representing a decrease of 13% compared to the same period last year. The domestic market continues to experience weaker demand due to the food category and economic headwinds, resulting in a 19.3% decline in the market for the crop year. Commitments increased by 3.5% compared to the previous month, but were down 4% compared to the previous year. Buyers are currently evaluating coverage for the first and second quarters and deciding when to enter the market. Buying hand-to-mouth and cautious selling has created a market with ample volume that can be covered in future periods.

Total liabilities currently stand at £545.2 million, representing a decrease of 10.8% compared to the previous year. New sales totaled £204.3 million over the course of the month, with the domestic market contributing an additional £57.3 million, while exports added a further £147 million in new coverage.

Total commitments for the domestic market now stand at £208.8 million and exports at £336.4 million. Uncommitted inventory has decreased by 1.3% compared to the previous year and now stands at £1.25 billion, down from £1.27 billion.

Yields through November totaled £2.2 billion, representing a 6.6% decline from the previous harvest year, primarily due to slower harvesting pace and lower crop yields. The total volume of the harvest will become clearer after observing pollinator revenues through December and remains well below estimates at the start of the season. In November, growers completed harvesting in the orchards and moved on to post-harvest work (fertilization, cover crop cultivation, tree pruning, sanitation, etc.). Most peeling machines are expected to be finished by the end of December, with a few continuing into early January.

LandIQ published its final estimate for the area under cultivation in 2025, which shows that the total area under cultivation continues to decline (the fourth consecutive year since 2021) and that the area under low-yield cultivation has fallen to a 16-year low. High-yield acreage is expected to reach a historic high of around 1.4 million hectares, but this does not include abandoned (unharvested) acreage due to the difficult economic situation facing producers and water availability.

The market continues to evolve against a backdrop of tightening supply and stable global demand. Export markets remain active, and buyers are exercising greater discipline in their hedging decisions as they assess the reduced supply base. Quality and size remain key differentiators, with premium segments continuing to command higher prices.

Looking ahead to 2026, disciplined pricing strategies and measured sales will be crucial to maintaining market stability and securing long-term value for all stakeholders.

Senior Sales Director Nut Ingredients