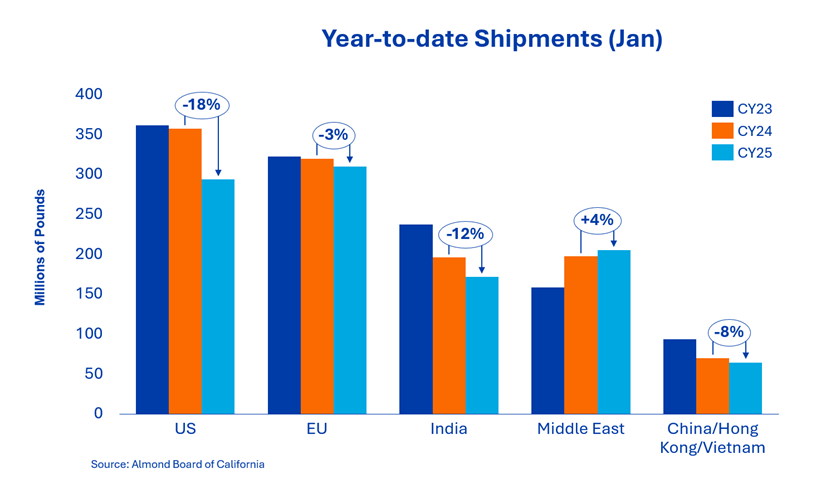

Shipments of almonds to India totaled 38.9 million pounds in January, virtually unchanged from a year ago. Year-to-date shipments remain about 12 % below last year's level, reflecting a cautious but deliberate buying strategy rather than a decline in demand. Importers' stocks remain low and prices on the local market continue to be higher than at origin. Market participants are continuing to keep a close eye on political developments and buying activity after the fair. This could have a significant impact on short-term coverage patterns.

Shipments to China/Hong Kong totaled 3.38 million pounds in January, an increase of nearly 19 % compared to January 2025. However, year-to-date shipments are at 16.8 million pounds, a decrease of 59 % compared to the same period last year. Shipments to Vietnam reached 1.4 million pounds in January, a decrease of 33.5 % compared to the previous year. Despite the weaker month of January, Vietnam remains above year-ago levels, with year-to-date shipments totaling 47.5 million pounds, an increase of 65 % compared to the same time in crop year 2024. On a combined basis for these regions, January shipments were down 3.4 % compared to last year. Year-to-date shipments are down 7.7 %, but the narrowing gap indicates a continued recovery trend.

Shipments in Europe totaled 48.3 million pounds in January, with Spain and Italy continuing to outperform their regional peers with a year-on-year increase of 13 % each. Overall, Europe is slightly behind last year with a year-on-year decrease of 3 %. European buyers remain value-oriented and tactical, maintaining their short-term coverage while limiting their long-term exposure. Demand fundamentals remain stable, with buying behavior responding strongly to price signals.

Deliveries to the Middle East reached 29.2 million pounds in January. Turkey, Israel and the United Arab Emirates continue to record year-on-year growth. Seasonal demand related to Ramadan and rising consumption in the downstream sectors have ensured a steady trend, while imports from Iran continue to dampen year-on-year growth. Buyers in the region continue to focus increasingly on premium grades and larger core sizes, limiting availability in certain specifications. Restocking for Ramadan has begun and buyers are returning.

Shipments in December reached 51 million pounds, a decrease of 17.3 % compared to the same period last year. The domestic market continues to see weaker demand, with results down 17.9 % overall since the start of the year. Futures contracts for the domestic market have fallen by 14 % compared to the previous year. Several macroeconomic factors continue to impact the domestic market and buyers are sticking to a strategy of short-term bookings due to uncertain demand. Many eyes will be on this market as we annualize the double-digit declines that began last March to determine if there are any directional changes for this important market.

Total commitments currently stand at £588 million, exceeding last year's level by £2.9 %. New business sales totaled £298 million over the month, with the domestic market bringing in an additional £62.4 million, down on last year's £90.6 million. Exports increased by an impressive 235 million pounds compared to the previous year's figure of 149 million pounds.

Total commitments to the domestic market now stand at 214 million pounds, while exports have reached 374 million pounds, providing a solid base for future deliveries. Uncommitted stock has increased by 2.1 % on the previous year and now stands at £1.19 billion compared to £1.17 billion.

Receipts through January totaled 2.63 billion pounds, down 1.4 % from the previous crop year. After looking at January receipts and reviewing the five-year average of receipts to the end of the year, the final harvest could be less than £2.7 billion.

All eyes are now on the blossom and the possible weather conditions in the coming weeks. Flowering is an important phase in the life cycle of almond trees, as it determines the production potential for the coming harvest year.

The January management report emphasized that the market is shifting from a supply-oriented to a demand-oriented pricing. An improved harvest forecast, strong sales figures and structurally undersupplied export markets support the stable to firm market outlook for the first quarter.

As the bloom progresses, price discipline and orderly market participation remain crucial. As global buyers continue to be selective and inventories are balanced, the market is in a position to respond constructively to rising demand rather than resorting to forced selling.

Senior Sales Director Nut Ingredients