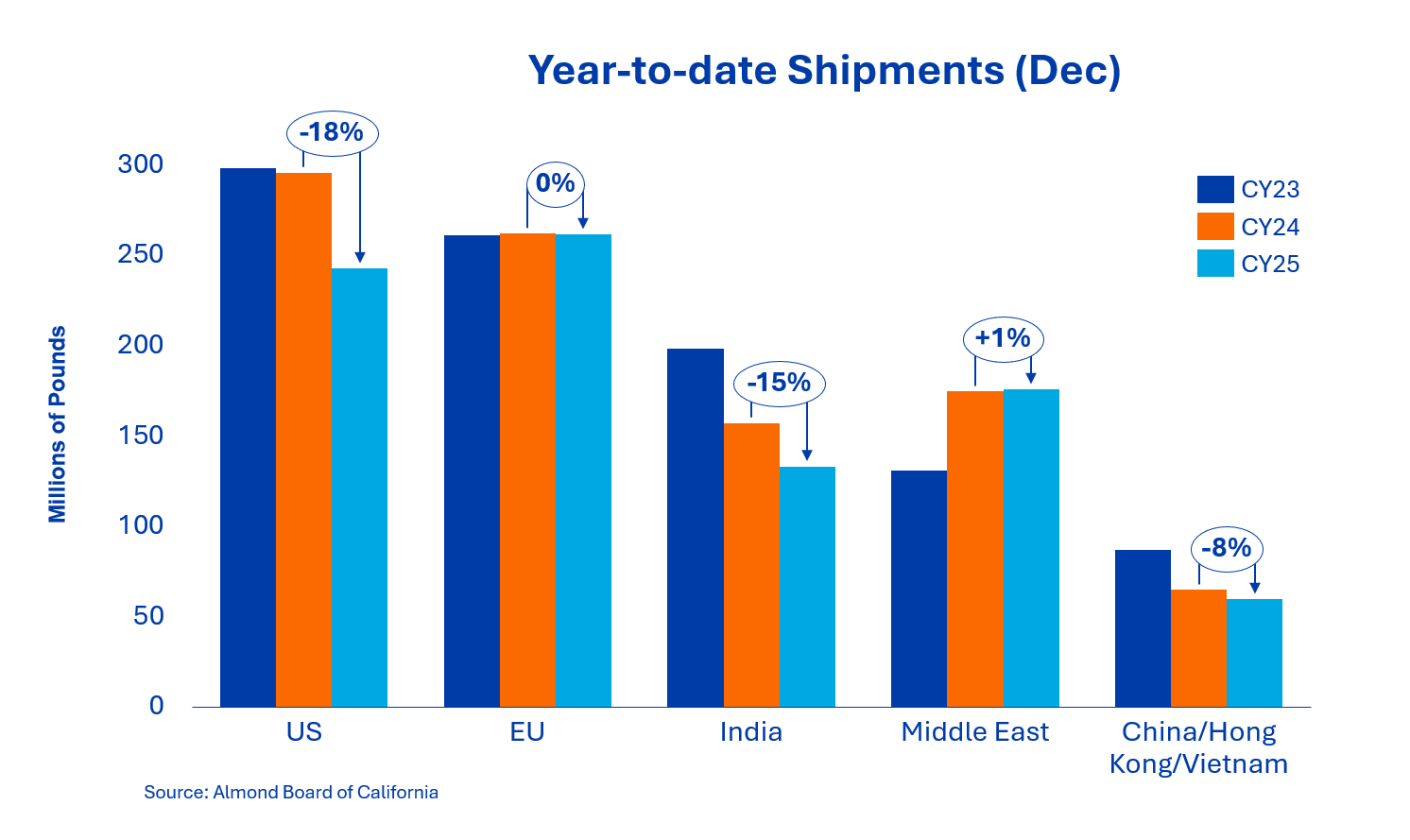

Deliveries to India totaled 33.8 million pounds in December. Year-to-date shipments totaled 132.8 million pounds, down from 157.0 million pounds in the same period last year, indicating a deliberate slowdown in the rate of procurement rather than a decline in demand. India remains structurally undersupplied compared to historical norms. While buyers continue to carefully manage their purchases, inventory levels remain low and the timing and extent of restocking will be a key driver of global prices and sentiment in the first half of calendar 2026.

Shipments to China/Hong Kong totaled 4.8 million pounds in December, an increase of nearly 31 % compared to December 2024. Despite the strong month, year-to-date shipments are at 13.4 million pounds, a decrease of 64.8 % compared to the same period last year Shipments to Vietnam totaled 3.63 million pounds, an increase of 6.8 % year-over-year. Vietnam continues to see strong cumulative growth with shipments of 46.1 million pounds year-to-date, an increase of 73 % over 2024, further strengthening its role as a key growth market for U.S. almonds. Overall, December shipments were up 19 % year-over-year, while year-to-date shipments were down only 8 % year-over-year, the smallest decline of the entire season. This indicates a further reduction in regional differences.

Total deliveries to Europe have amounted to 261.4 million pounds since the beginning of the year, remaining almost unchanged compared to the previous year. Within the region, Spain continues to perform above average, while the Netherlands and parts of Northern Europe remain weaker. European buyers remain selective and value-oriented, securing short-term supply while limiting their forward exposure. The fundamentals of demand remain intact, but buying behavior continues to be characterized by cautious purchasing strategies.

Shipments to the Middle East have reached 175.8 million pounds since the beginning of the year, an increase of 1 % on the previous year. Turkey emerged as a notable bright spot in December and is now 12 % above last year's level. Lebanon and Israel also recorded robust year-on-year growth. Saudi Arabia, on the other hand, recorded a year-on-year decline of 42 %. The region continues to see rising demand, with buyers increasingly focusing on premium qualities and larger grain sizes.

Shipments in December reached 49.1 million pounds, a decrease of 12.4 % compared to the same period last year. The domestic market continues to see weaker demand, with overall results down 18 % since the beginning of the year. Forward contracts for the domestic market total 202.6 million pounds, down 7.96 % from a year ago, demonstrating buyers' continued strategy of booking only short-term supply. Buyers are expected to become more active in the coming weeks to cover the remaining demand for the first and second quarters.

Total commitments currently stand at £496.2 million, down £11.6 % on the previous year. New business totaled 196.7 million pounds during the month, with the domestic market bringing in an additional 42.8 million pounds and the export sector a further 153.9 million pounds in new business.

Overall, commitments for the domestic market now amount to just over 202 million pounds, while exports are just over 293 million pounds. Uncommitted stock has increased by 4.4 % on the previous year and now stands at 1.38 billion pounds compared to 1.32 billion pounds.

Receipts through December totaled 2.51 billion pounds, down 2.5 % from the previous crop year. Based on December receipts, the total harvest is expected to be around 2.7 billion pounds. This season, the slower pace of receipts was exacerbated by late fall and early winter rains.

All peeling and coring operations will have completed their work by the end of January. Producers will continue to focus on post-harvest activities in the orchards. The next important milestone, which will give a first insight into the 2026 harvest, is the bloom in February.

The December position report confirms that the market is moving towards a more balanced supply and demand profile. Export demand continues to become stronger and more geographically diverse, while weak domestic demand remains the biggest obstacle to overall supply growth. Security of supply has improved significantly and shipments continue to confirm that the crop is smaller than originally forecast.

As the industry enters the first quarter and approaches its prime, market fundamentals point to stable to firm performance, especially as India and other key export markets begin to accelerate their coverage. With balanced inventories, conservative commitments and below average coverage by global buyers by historical standards, the market is increasingly geared towards improving confidence and more stable pricing.

Discipline remains critical as the industry works towards a sustainable balance that supports long-term demand growth and grower returns. Meet Blue Diamond at the Peanut and Tree Nut Processors Association, MEWA India or at Gulfood.

Senior Sales Director Nut Ingredients