Shipments totaled 35.4 million pounds in May, down 23 % from the previous month, but up 9 % from last year. The year-to-date shipments backlog is now 3 %, with total shipments reaching 342.4 million pounds compared to 353.6 million pounds at the same time last year. India continues to build stocks in preparation for the early Diwali festival in 2025. The general market consensus is that goods need to be delivered by mid-July to arrive in time for the festive season. With demand expected to remain strong during the transition to the summer harvest, tight stocks in California could make it difficult for buyers to secure their preferred sizes. New crop trading remains limited as traders focus on clearing the remaining volumes of the 2024 crop.

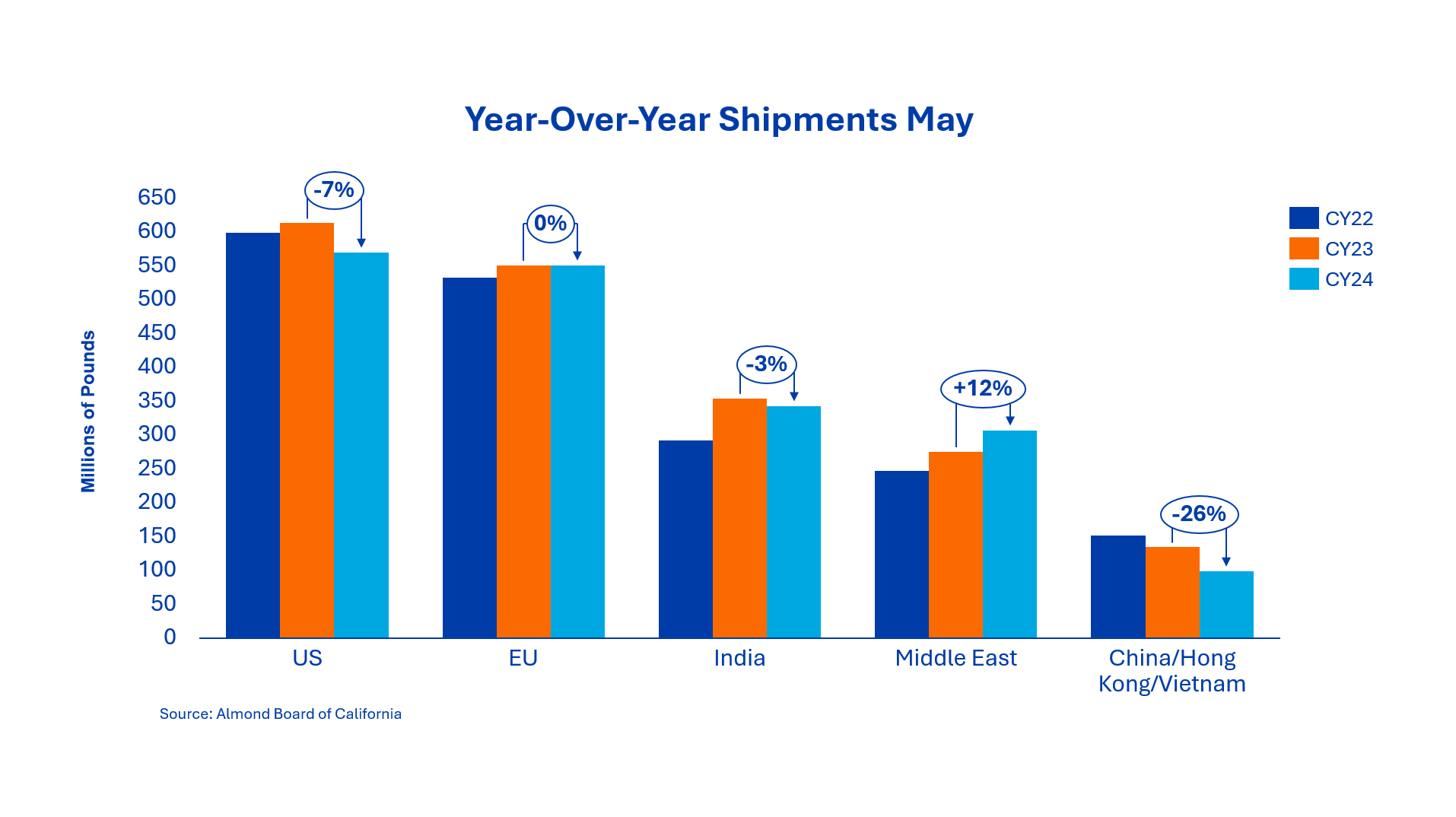

Shipments to the region totaled 9.0 million pounds in the month under review, a slight decrease of 0.6 % compared to the previous year. Since the beginning of the year, shipments have fallen by 26 % as tariffs continue to weigh on new sales to the region. Vietnam has become a major value-added hub, importing 15.9 million pounds more almonds this crop year than last year - an increase of 46.4 % year-on-year through May. Much of this product is processed and re-exported to China. Singapore and Malaysia also recorded strong growth, with import volumes increasing by 80 % and 44.0 % respectively. Overall, Southeast Asia has grown by over 28 % since the beginning of the year. Other markets such as Thailand, Indonesia and the Philippines remained relatively unchanged. Despite the reduction in tariffs to 45 % for in-shell and kernel almonds imported into China, only limited volumes entered the market directly. Shipments from China/Hong Kong have fallen by around 50 % compared to the same time last year, although the volumes of shelled almonds are not included in the May report. In Taiwan, on the other hand, shipments have increased by 27 % since the beginning of the year. In Southeast Asia, there was already an upward trend before the escalation of trade tensions between the USA and China. However, Chinese buyers have increasingly turned to alternative countries of origin - particularly Australia - where tariff advantages continue to influence purchasing decisions.

Europe recorded 51.6 million pounds in May, an increase of 7 % compared to May 2024. Year-to-date, the region is flat year-on-year, although trends vary across countries. Germany and Spain continue to see double-digit year-on-year declines, while the Netherlands and Italy have seen significant growth. Following earlier phases of brisk buying, demand has been subdued recently due to the ongoing uncertainty about possible tariffs. If there is clarity soon, the region could see an upturn towards the end of the harvest year, especially if buyers want to take advantage of recent price reductions.

The Middle East continues to perform well, with shipments totaling 31.3 million pounds in May, up 2 % from May 2024. Year-to-date, the region has continued to see double-digit growth, reflecting continued strong demand for California almonds - up 12 % year-over-year. Growth was driven primarily by the United Arab Emirates, Turkey and the Kingdom of Saudi Arabia. Destination prices in the United Arab Emirates and Mersin remain below origin levels, with discounts of 15 to 20 cents per pound. As we enter the summer months, consumption is likely to slow, so it will be important to see if the region can maintain its current pace. Following the end of the Eid al-Adha festival, buyers are expected to return to the market following this week's shipping report. Many have already stocked up for the end of the year and are likely to start securing new crop volumes to position themselves well ahead of early Ramadan.

A total of 51.03 million pounds were shipped in May, a decrease of 22.3 % compared to the same period last year. This brings year-to-date shipments to 569.8 million pounds - a decrease of 7 % compared to last year. The domestic market has now seen seven consecutive months of year-on-year declines, with double-digit falls in each of the last three months. However, booking activity is expected to increase ahead of the target estimate as buyers seek to take advantage of recent price reductions.

Total commitments reached 402 million pounds, down 12.7 % on the previous year. New sales this month were relatively weak at 89 million pounds, down 34 % from last year. Current shipments and commitments account for 84.3 % of total supply, slightly below last year's level of 86.5 %. It is expected that the industry will continue to face a similarly tight supply as last year.

New crop sales are reported at 65.7 million pounds, down significantly from 173 million pounds at this time last year. The ongoing uncertainty regarding tariffs and the size of the crop continues to be a limiting factor in forward bookings.

The market continues to monitor the harvest and awaits further clarity from the publication of the objective estimate on July 10.

Overall, the market fundamentals remain solid and another tight carryout is expected - similar to last year. Global demand remains strong in most export regions, with further growth expected in India and the Middle East.

However, uncertainty over potential tariff changes and the 2025 crop outlook are contributing to subdued market activity as buyers continue to go hand to hand to finalize contracts. This cautious behavior is exerting downward pressure on prices, which are expected to stabilize once there is more clarity following the upcoming NASS target estimate.

Senior Sales Director Nut Ingredients