Shipments in October totaled 28.3 million pounds, nearly the same as the previous month and down 4 % from a year ago. The year-to-date difference is currently 29 %, with total shipments at 72.8 million pounds, compared to 102.1 million pounds at the same time last year. October shipments of unshelled nuts show that India remains reluctant to buy at California prices as uncommitted cargoes from California continue to depress local market prices and sentiment. The market remains undersupplied and the timing and volume of further Indian purchases will be an important factor in price movements through the end of the year.

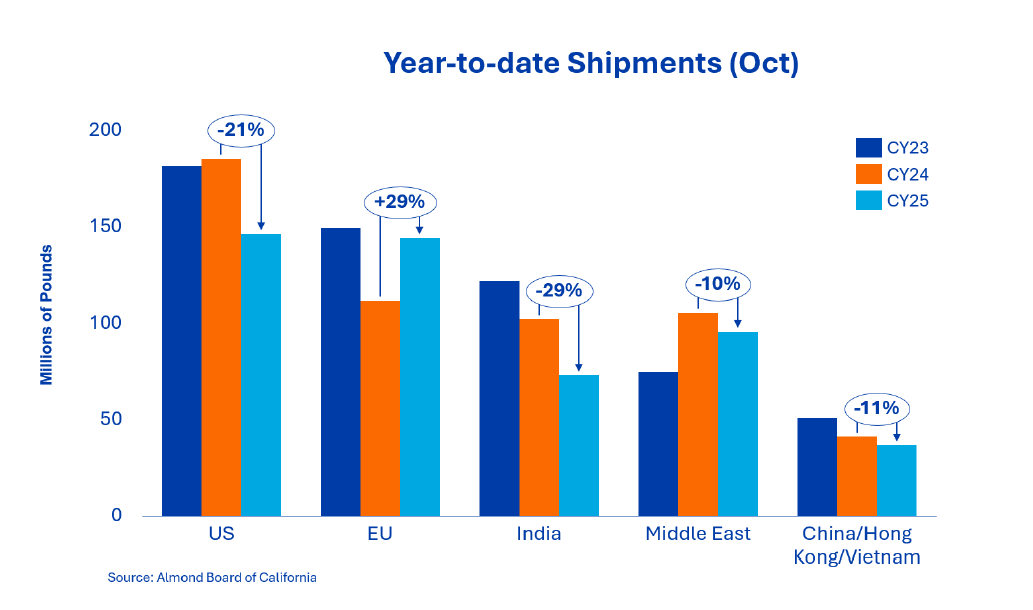

Shipments to the region totaled 20.4 million pounds in October, with Vietnam again accounting for the largest share. The market continues to show upward trends, recording 30.1 million pounds over the month, an increase of 132 % from October and an increase of 94 % year-to-date - a remarkable performance by any standard. On the other hand, China/Hong Kong remains weak, reflecting the structural downturn we have seen all season. Shipments fell by 73 % in October and by 75 % year-to-date. Shipments to the region as a whole fell this month and were 2 % and 11 % lower than last year. We expect the region to recover by 10 % next month due to the recent reduction in tariffs in China.

Europe continues to be the outstanding growth region at the start of this harvest year. Total deliveries to Europe have amounted to around 144 million pounds since the beginning of the year, which corresponds to an increase of around 29 % compared to the previous year. Western Europe alone has seen an increase of 31 %, with Spain, Italy, Germany and the Netherlands recording the largest increases. Buyers remain selective and value-oriented, but the growth shows that European demand is increasing and will absorb a significant portion of this year's crop.

Shipments to the Middle East totaled 47.2 million pounds in October, down 17.4 % from the previous month and 9.6 % from a year ago. Despite the weaker results, the region remains a key growth market for California almonds. While volume growth lags behind Europe, demand for quality products continues to rise, with buyers increasingly opting for premium qualities and larger sizes.

Shipments in October reached 48.2 million pounds, down 28.5 % on the same period last year. The domestic market has now seen twelve consecutive months of weaker demand, resulting in a 21.2 % decline in the market. Corresponding commitments were up just over 5 % on the previous month, but up 7.5 % on the previous year. Buyers have been evaluating holiday and coverage forecasts through the first quarter of 2026 and are waiting for a price drop to decide when to enter the market, as there is sufficient demand for future delivery periods.

Total commitments currently stand at 561.5 million pounds, a decrease of 16.7 % on the previous year. New business sales totaled 261.8 million pounds during the month, with the domestic market contributing an additional 62.5 million pounds, while exports added a further 199.3 million pounds of new business.

Overall, commitments for the domestic market now amount to 198.9 million pounds and exports to 458.1 million pounds. Uncommitted stock stands at 982.2 million pounds compared to 997.1 million pounds in the previous year, a decrease of 1.5 %.

Yields through October were 1.7 million pounds, a decrease of 7.9 % from the previous crop year, primarily due to a slower harvest pace. Harvest yields are lower overall due to lower nonpareil yields and overall lower yields (kernel weight as a percentage of shell, hull and kernel). Given these factors and considering the year-over-year comparisons between orchards, the overall crop size will challenge even the Subjective estimate of 2.8 billion pounds. Pollinator yields through December will provide insight into the overall crop size. In October, growers attempted to complete harvest operations in the fields, but some were delayed by a severe weather phenomenon.

The storm forced growers and peelers to adjust their operations and focus on inbound field supplies rather than stocks. Higher rejection rates were observed for later harvested varieties, but overall rejection rates are below those of crop years 2023 and 2024. LandIQ will publish the final acreage estimate for 2025 in November, providing insights into orchard clearings, new plantings and yield areas. This will provide information about the future harvest potential.

The October report provided more clarity on the fundamentals of the market and reinforced the upward trend across the industry. Currently, supply is significantly tighter than last year and export demand continues to gain momentum, with shipments above last year's levels. For the remainder of the fourth quarter and the start of 2026, market sentiment points to a stable to firm trajectory, with potential for further strengthening should India and other key target markets accelerate their coverage.

As the market moves towards a more disciplined and sustainable balance between supply and demand, confidence is returning on both sides of the trade. Stable fundamentals and consistent export performance provide a solid foundation for informed purchasing decisions and long-term value creation.

Senior Sales Director Nut Ingredients