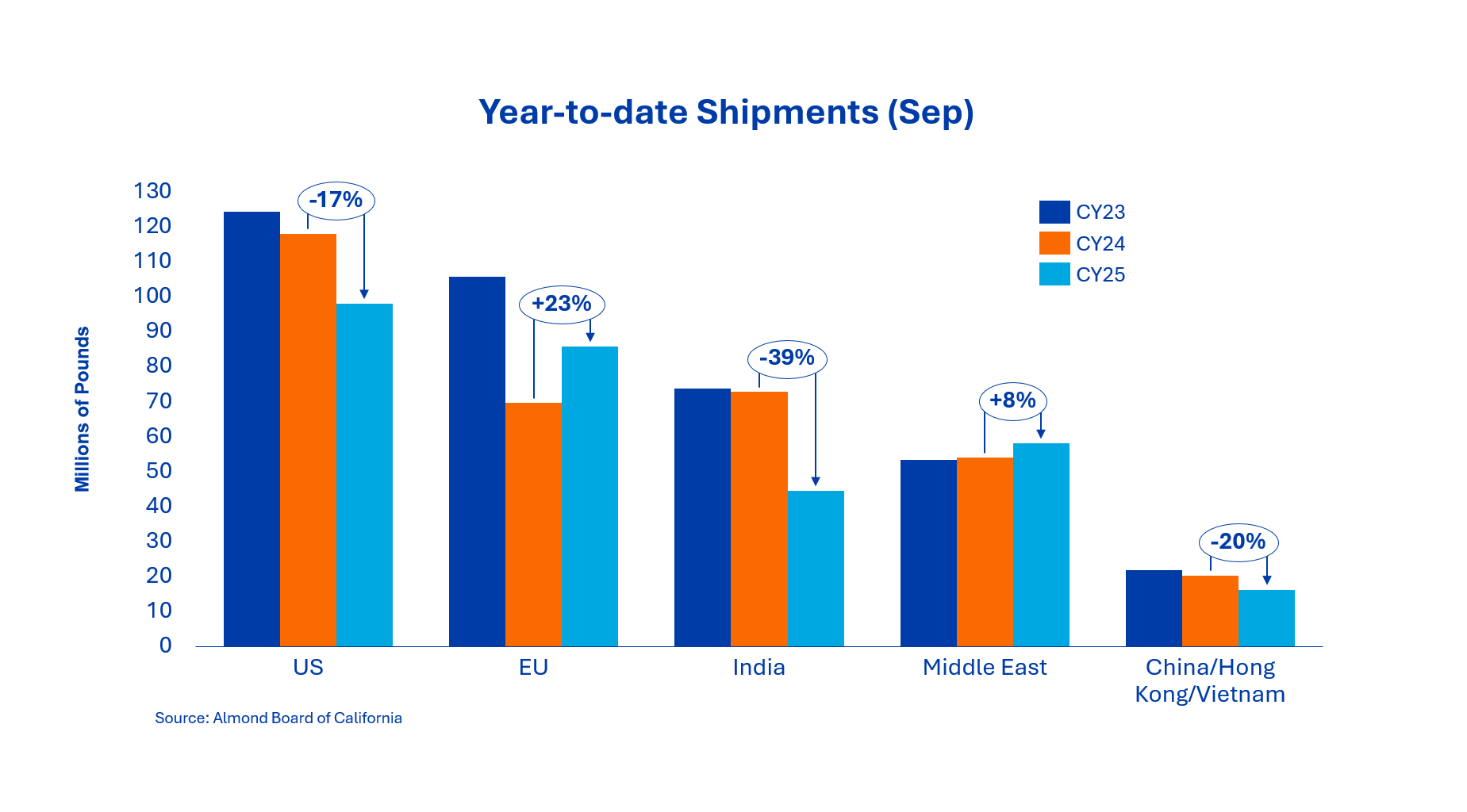

September shipments to India amounted to 28.1 million pounds, bringing the cumulative total volume to 44.5 million pounds - a decrease of 39 % compared to the previous year.

The slow start was due to low early arrivals and limited ship availability.

In the meantime, however, Indian importers have started to increase deliveries for November, as the low arrivals in August and September have tightened local stocks.

A significant increase in purchasing activity is expected for the second half of October.

Deliveries to this region amounted to 12.0 million pounds in September, with Vietnam accounting for the largest share at 10.6 million pounds (+139 %).

China/Hong Kong, on the other hand, recorded a decline of 86 % to 1.4 million pounds.

This development reflects an ongoing restructuring of trade between direct and transit trade channels, while China continues to build up its stocks conservatively ahead of the Chinese New Year. Vietnam's strength is based on increased processing and re-export activity of kernels to Southeast Asia.

European deliveries in September amounted to just over 42 million pounds, bringing the year to date volume to 85.7 million pounds - an increase of 23 % on the previous year.

Spain and Italy led regional growth as buyers took advantage of recent price falls to secure coverage for the fourth quarter.

Although the purchasing strategy remains cautious and rather short-term, the mood has improved after the ANUGA trade fair and several buyers are now likely to start building up their stocks again.

Deliveries to the Middle East amounted to 31.0 million pounds in September, a decrease of 18.5 % compared to the same month last year.

Strong deliveries in August have offset this monthly decline, meaning that cumulative annual deliveries for the region have remained stable overall. The earlier Ramadan date of 2026 continues to influence purchasing strategies as importers cover their requirements earlier than usual.

Market reports point to continued strong momentum in October, with solid coverage until the end of the year.

Domestic sales amounted to 49.5 million pounds in September, a decrease of 11.5 % compared to the same month last year.

This was the eleventh consecutive month of negative year-on-year figures, leaving the market 16.9 % down year to date; the corresponding commitments fell by 12.6 %. The economic situation remains challenging, which means that consumers are increasingly rethinking their purchases - particularly in the snack sector. Shoppers continue to act cautiously and mostly buy on demand at short notice.

Total liabilities currently stand at 548.9 million pounds, a decrease of 17.7 % compared to the previous year.

New sales for the month amounted to 219.6 million pounds, with the domestic market contributing 63.3 million pounds and the export market 156.3 million pounds of new cover.

In total, the commitments now amount to 184.7 million pounds for the domestic market and 364.3 million pounds for export.

Harvest receipts up to the end of September reached 992 million pounds, a decrease of 4.2 % compared to the previous year.

The lower harvest volumes reflect lower yields in non-pareil varieties and slower throughput in peeling operations - caused by higher moisture and thicker shells.

In September, the harvest shifted from Nonpareil and Independence to the Pollenizer varieties.

There are some concerns about rejection rates due to the navel orange worm, especially in later varieties, but overall quality is expected to be better than in the 2023 and 2024 crop years.

A comparison of the early varieties shows that a 3 billion pound crop is very unlikely and challenges even the 2.8 billion pound estimate.

Over the next few months, the receipts of the Pollenizer varieties will be decisive in determining the overall harvest volume.

Most growers plan to complete field work by the end of October, while the industry keeps an eye on the upcoming storms in California and the potential impact on crop volumes and quality.

The market situation has stabilized after the weak phase in the second half of September.

Sellers were active before the publication of the September report, while buyers remained cautious and only covered short-term requirements.

With lower crop receipts, positive quality tests and rising forward sales, the short-term environment appears constructive.

The industry is expecting a strong October, supported by renewed demand from India and Europe.

Although prices are likely to remain within a range in the short term, tighter supply conditions and stable export demand suggest a gradually firmer price trend in the second half of the fourth quarter.

As soon as market participants have more clarity about total production and caliber, implementation and quality differences will continue to be the price drivers - especially for premium nonpareil and large cores.

Senior Sales Director Nut Ingredients