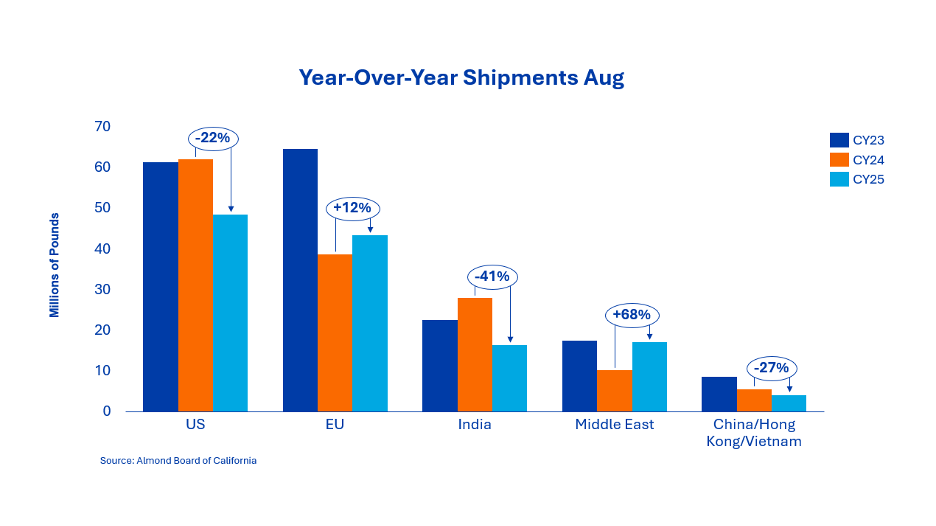

Almond shipments to India amounted to 16.4 million pounds in August, down 41 % year-on-year. This weaker start to the 2025 crop year had been expected after shipments in July were exceptionally strong and the harvest was slightly delayed. Despite the decline in August, India is largely unsupplied for September, positioning the market for a significant recovery in the upcoming shipping report. As the harvest year progresses, attention is turning to covering the remaining demand for Diwali through local stocks, while Diwali demand is expected to again generate strong interest in Californian almonds.

Deliveries to the region amounted to over 4 million pounds, down 27 % on the same month last year. Activity is expected to pick up in the coming weeks as buyers look to cover their needs for the Chinese New Year.

The European market showed moderate strength in August with deliveries of just over 43 million pounds, up 12 % year-on-year. European buyers are acting with discipline and only entering the market when necessary, continuing to pursue a cautious hand-to-mouth strategy. Although the recent suspension of EU customs measures has provided some relief in terms of forward cover, it has not created any pressure to act. Sellers are only selectively releasing their volumes to preserve the opportunity to achieve better values after more clarity on the harvest.

The Middle East was very active at the start of the 2025 harvest year. Shipments reached more than 17 million pounds in August, almost 68 % above the previous year's level. The earlier Ramadan in 2026 is already shaping buying behavior, as importers are securing their requirements well ahead of the shipping freeze in November. Despite this activity, many market participants are initially taking a wait-and-see approach in order to await the August shipping report and gain more clarity about the upcoming harvest. The level of activity is therefore expected to remain high following the publication of the report. After the strong performance in crop year 2024, it will be interesting to see whether this performance can be repeated.

Deliveries in August amounted to 48.45 million pounds, down 21.9 % on the same period last year. This was the tenth consecutive month of year-on-year declines. Despite the more optimistic results in July, the sharp year-on-year declines continue. New business for the month amounted to £55 million, a fall of £7.11 % on the previous year. While strong domestic business was a positive aspect, a significant amount of demand remains unmet. In light of last year's performance, demand in the domestic market will continue to be monitored closely in order to identify potential further declines at an early stage.

Total commitments at the beginning of the year amounted to 526.6 million pounds, a decrease of 13.2 % on the previous year. New business in the month totaled 184.1 million pounds, with the domestic market adding an additional 55 million pounds and exports securing 129.1 million pounds of new cover.

Overall, commitments for the domestic market now amount to 170.9 million pounds, while exports total 355.7 million pounds.

Crop receipts to date total 259 million pounds, 10.7 % below last year's level. Recently, concerns about lower yields from the central and southern part of the valley have increased, particularly for early varieties such as Nonpareil, which account for around 40 % of the total crop.

Many industry representatives doubt the feasibility of the objective crop estimate of 3.0 billion pounds, and some even speculate that the final yield could fall below the subjective estimate of 2.8 billion pounds. As a result, Californian processors are currently taking a cautious approach and limiting their offers until there is more clarity about the potential of the new crop.

The carry-in figure was the most notable surprise in this position report. The carry-out from the July report was adjusted with an actual loss and exception rate of 3.14 %. This puts the official carry-in at 483.8 million pounds.

Additionally, the Almond Board of California conducted a voluntary survey this year on the edible portion of the 2025/26 carry-in stock. Based on these results, it is estimated that only 92.4 % of the total carry-in is considered edible, further reducing the number to an estimated 447 million pounds.

In view of this expected carry-in and the skepticism regarding the objective estimate of 3.0 billion pounds, California is acting cautiously with regard to the volumes offered. Prices have risen sharply over the past month and are expected to remain high as buying continues in the coming weeks. Harvest is underway and more clarity on the 2025 crop is expected as receipts are assessed for quality, size and overall potential.

Senior Sales Director Nut Ingredients